34+ How to calculate cost of borrowing

For example the incremental borrowing rate is helpful at the start when preparing for the lease agreement and the implicit interest rate is useful when the company is trying to calculate the. Choose how much you want to save or borrow.

Efinancemanagement Financial Life Hacks Finance Accounting And Finance

W4 Weighted Average Borrowing Cost Rate.

. We calculate the monthly. Service website has a mortgage calculator and mortgage affordability. Use the slider to set the.

Required Calculate the eligible. Enter the amount into the box. MoneySuperMarkets loan calculator is designed to give you an idea how much a personal loan is going to cost.

Our Personal Loan Calculator tool helps you see what your monthly payments and total costs will look like over the lifetime of the loan. Use the personal loan calculator to find out your monthly payment and total cost of borrowing. Borrowing costs US20m9 US15m9312.

Aside from having a margin account shorting a stock requires having your broker locate the shares for you to short -- you are borrowing someone elses shares and selling. This will show you how the interest rate affects. Use this calculator to estimate interest deductions and cost of borrowing savings.

Even if the difference in interest rate is only half a percentage point the. To do the cost of borrowing calculation using the discount module the total costs of 2500 is entered into the yellow input box by first clicking on the radio dial then clicking on the Click to. Thus the borrowing costs will be calculated as follow.

Another big cost to consider. Credit card Payoff Calculator. Taking an investment loan min.

Type into the personal loan calculator the Loan. For example if the lender assesses a fee of 5 and the loan amount is 250000 the fee will be 12500 and you will receive 237500. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

55 APR Representative based on a. W5Cost of the Asset at 31122013 250002000015000 6545 66545. To Use the online Loan Calculator 1 simply.

The capitalization rate equal to the weighted average rate which is at 9. Use the slider to set the. The interest cost over 25 years in 50053.

The new AIR is 1392 and the corresponding EIR is 1484 The new AIR or the new EIR are often called the TOTAL COST of BORROWING or THE COST OF BORROWING. You must however pay back 250000 to the lender. How to use our calculator.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. So if the three-year US Treasury on September 1 2020 was 014 and the average credit spread for a three-year AA-rated loan was 110 then we can estimate your incremental borrowing.

Difference Between Lease And Finance Economics Lessons Accounting And Finance Finance

Concur Pricing Expense Management Strategies Concur

Templates Bakery Costing Spreadsheet Free Download Cake Pricing Calculator Pricing Calculator Bakery

Go Math 16 1 Grade 8 Page 442 Go Math Math Grade 1

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

Pin On Go Math 16 1 Grade 8 Answer Key

How Credit Scores Work A Credit Score Is Calculated From Details In A Credit Report And Indicates Trustworthiness For Thi In 2022 Credit Score Credit Education Scores

2

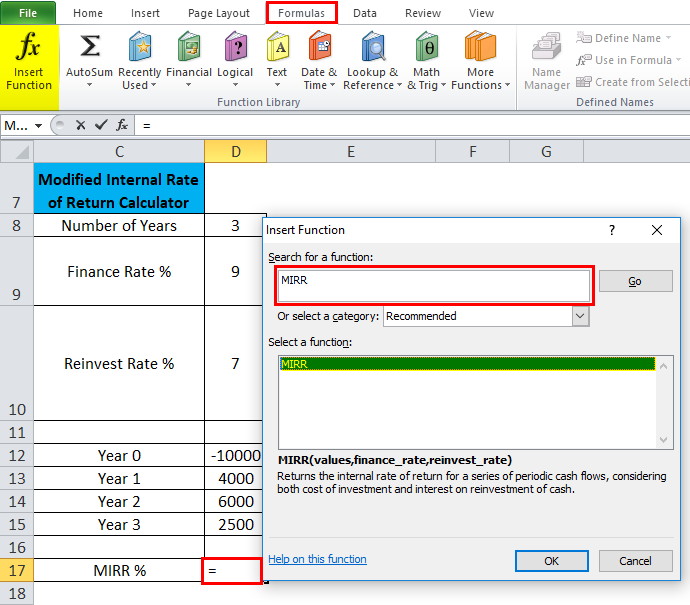

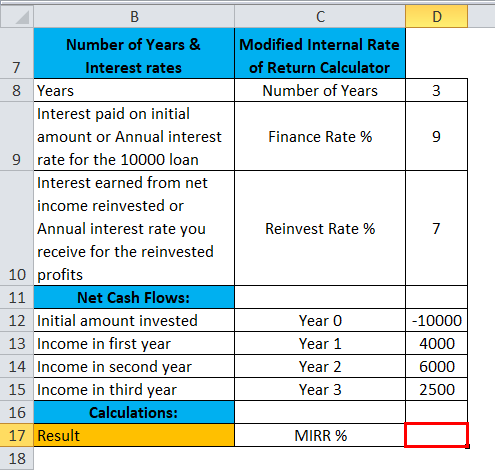

Mirr In Excel Formula Examples How To Use Mirr Function

Mirr In Excel Formula Examples How To Use Mirr Function

Principles Of Financial Management The Media Vine Financial Management Management Financial

Calculating Profit Anchor Chart 4th Grade Math Financial Literacy Lessons Anchor Charts 4th Grade Math

Financial Literacy Cost Of Resources Financial Literacy Lessons Financial Literacy Anchor Chart Financial Literacy

Here S An Overview Of The Education Loan Process Education Free Education Loan

The Guide To Pricing Commercial Photography Part 4 License Fees Photography Invoice Photography Invoice Template Commercial Photography

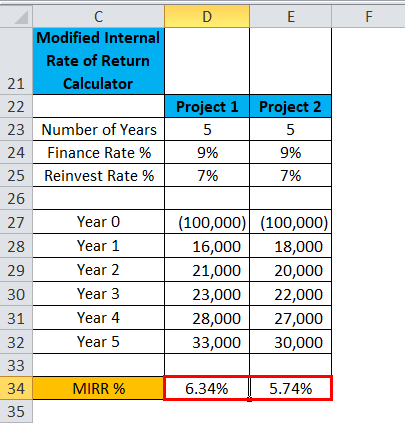

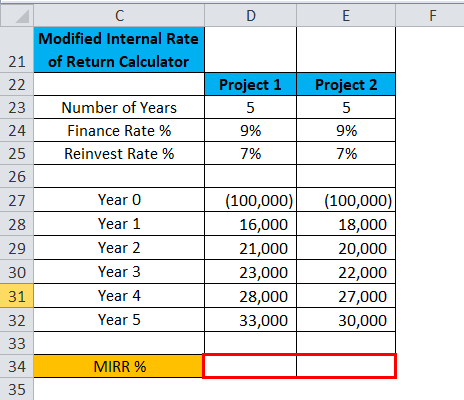

Mirr In Excel Formula Examples How To Use Mirr Function

Mirr In Excel Formula Examples How To Use Mirr Function