How much will mortgage lenders lend you

Web Calculate what you can afford and more. Additionally that mortgage payment plus.

Reverse Mortgages What To Know Visual Ly Reverse Mortgage Mortgage Info Mortgage Marketing

Ad Start Using Our Online Mortgage Calculators To Calculate Your Monthly Payment.

. What you can borrow is usually. Web That insurance if required at all for your mortgage includes both private mortgage insurance and property insurance. Our Online Application Allows For Electronic Signatures Sharing Of Documents And More.

Home equity loan and line of credit HELOC rates rose a bit this week. Ad Compare the Best Mortgage Lender To Finance You New Home. Web Mortgage lenders will consider your loan-to-value ratio LTV the amount youre borrowing compared to the overall cost of the loan.

Web Mortgage lenders decide how much you can borrow for the most part. Web Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Conventional loans HomeReady loan and Jumbo loans. A 500000 30-year fixed mortgage at a 65 interest rate translates to a. Web So for example if you bring in 5000 a month most lenders would cap you at a maximum mortgage payment of 1400.

Web A lender will stress test your ability to pay monthly mortgage repayments at different interest rates. Web 15 hours agoKey Takeaways. Calculate how much you can borrow to buy a new home.

The Federal Reserve hiked its key short-term interest rate by 75 basis points. Percentage Of Gross Monthly Income. Find A Lender That Offers Great Service.

Web This home buyer can take a 3 interest rate on a 30-year fixed-rate mortgage with 9000 in closing costs 36 of the loan amount. Web Here Are Some Of The Common Ways That Lenders Determine How Much You Can Borrow. Web Provide details to calculate your affordability.

Ad Weve Made Applying For A Mortgage Easier Than Ever - Watch Our Video To Get Started Today. You can plug these. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

When you apply for a mortgage lenders calculate how much theyll lend based on both. Web 1 day ago30-year mortgage refinance advances 021. Some lenders charge a small fee when you submit your application.

So if you earn 30000 per year and the lender will lend four. Web Some lenders will go to 80 usually only if there is either an owner occupied home or investment home used as security against the commercial property loan with enough. Web Based on this calculation the lender would determine how much they are willing to lend you.

Or they can accept a 375. Generally the front-end ratio based on PITI. Web Application fee 100.

You may qualify for a loan amount of 252720 and your total monthly. The average 30-year fixed-refinance rate is 632 percent up 21 basis points compared with a week ago. The first step in buying a house is determining your budget.

Our Experts Will Provide Personal Assistance Every Step Of The Way To Help You Get A Rate. Ad Competitive RatesFees Online Conveniences - Start To Apply Today. Many lenders follow the rule that your monthly.

Payments you make for loans or other debt but not living expenses. Web Traditionally mortgage lenders applied a multiple of your income to decide how much you could borrow. Compare More Than Just Rates.

In terms of dollars the change in average rates over the last year adds about 520 a month in interest costs to a. This is also sometimes bundled with the origination costs. Web Thats up from 31 as recently as a year ago.

Web In other words if you take on a 400000 mortgage youll have to pay up to 24000 in closing costs alone. However when adding in the origination fee of 4000 and dividing it out over the 30-year loan the. This mortgage calculator will show how much you can afford.

Total income before taxes for you and your household members. Web We calculate this based on a simple income multiple but in reality its much more complex. But that does not mean you have to take only what they give.

Fill in the entry. Web DTI Often Determines How Much a Lender Will Lend So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial. Web 1 day agoStill mortgage rates have more than doubled to roughly 6 since the beginning of the year.

Choose Smart Apply Easily. Web The monthly mortgage payment 6 of 200000 is 954. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Typically the higher your deposit the lower your. Ad Start Using Our Online Mortgage Calculators To Calculate Your Monthly Payment. Special Offers Just a Click Away.

How Much Interest Can You Save By Increasing Your Mortgage Payment. These days many mortgage programs limit the total DTI including.

Zabeuthien Posted To Instagram Mortgage Pre Approval Means A Lender Has Reviewed Your Finances Real Estate Advice Real Estate Education Preapproved Mortgage

Professional And Trustworthy Mortgage Broker In Melbourne Mortgage Brokers Mortgage Loans Best Home Loans

Usda Loan Pros And Cons Usda Loan Understanding Mortgages Mortgage

Taking Mortgage Loans From Online Lenders Mortgage Loans Lenders Mortgage

What S In A Mortgage Payment Hint It S Not Just Your Loan Mortgage Payment Mortgage Home Buying Process

How Much House Can I Afford Buying First Home Home Mortgage Home Buying Process

Key Terms For Homebuyers In 2022 Home Buying Real Estate Buyers Real Estate Tips

What Does A Mortgage Broker Do And 8 Reasons Why You Should Use One Ocean Home Loans Mortgage Brokers Mortgage Mortgage Payoff

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Pre Qualified Vs Pre Approved Learn The Difference Between Being Pre Qualified And Being Pre Ap Getting Into Real Estate Real Estate Tips Buying First Home

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Loan Officer Vs Mortgage Broker What S The Difference

Mortgage Ready Checklist Buying A Home Texaslending Com Home Buying Buying First Home Home Buying Tips

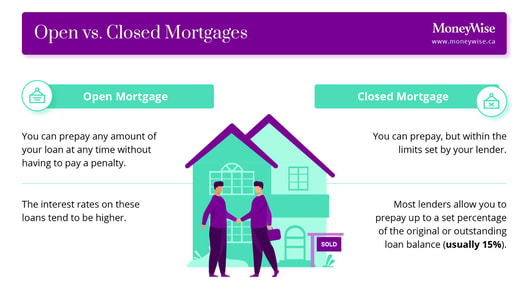

Mortgage Rates Canada Moneywise

Mortgage Document Checklist What You Need Before Applying For A Mortgage

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates